Gas Line Explosions, Summer Heat Storms, and Wildfires, Oh My!

- despite all of these challenges, Diablo Canyon Power Plant (DCPP) stabilizes California electricity prices.

Judy Garland and Terry from the Wikipedia article, “The Wizard of Oz.” (Public Domain)

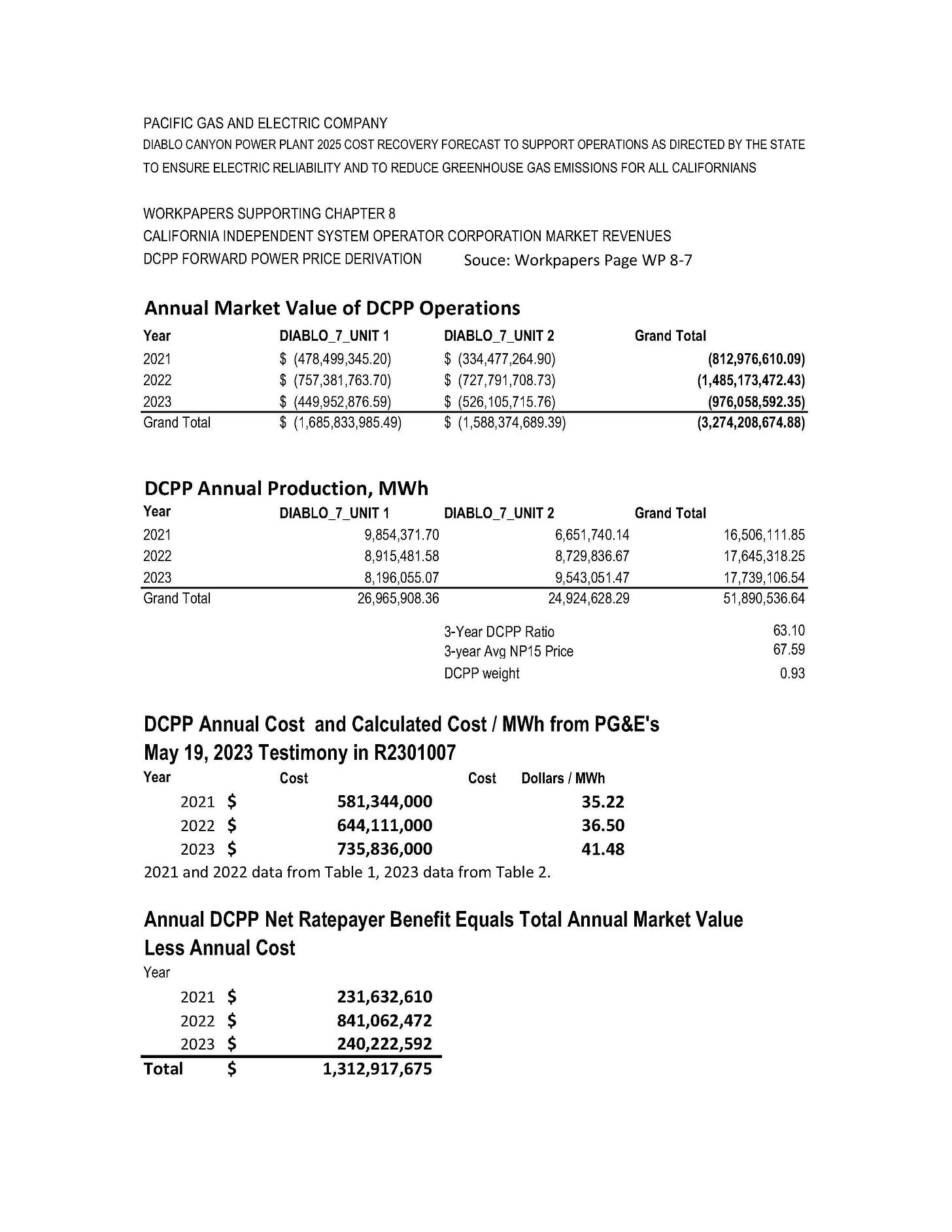

This article is a summary of CGNP's August 20, 2024 Rebuttal Testimony in the current Diablo Canyon cost proceeding before the California Public Utilities Commission. The Parties opposed to DCPP extended operations continue to exaggerate the plant's cost. Opponents ignore the unique provision in Section 712.8 (h) (3) of California SB 846 (Dodd, 2022) that provides for ratepayer refunds of DCPP market revenues in excess of plant operational costs.

If the SB 846 rules regarding rebates of any excess market revenues in excess of DCPP's operation costs had applied, ratepayers would have been entitled to $1.313 billion in total rebates for the years 2021, 2022, and 2023. CGNP shows some of the factors that dramatically increased California wholesale electricity rates below. These are some of the reasons why California's electricity prices are typically the most expensive in the continental U.S.

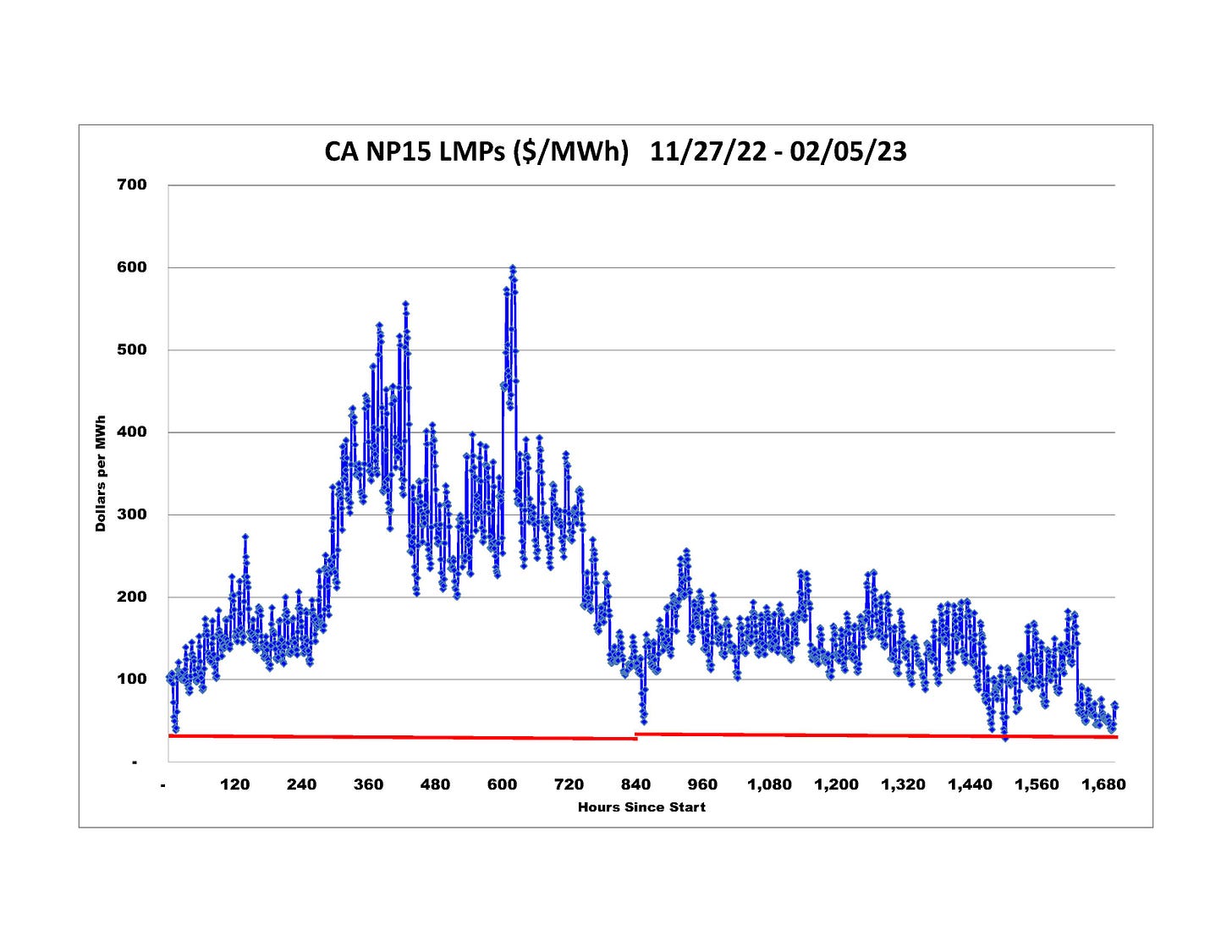

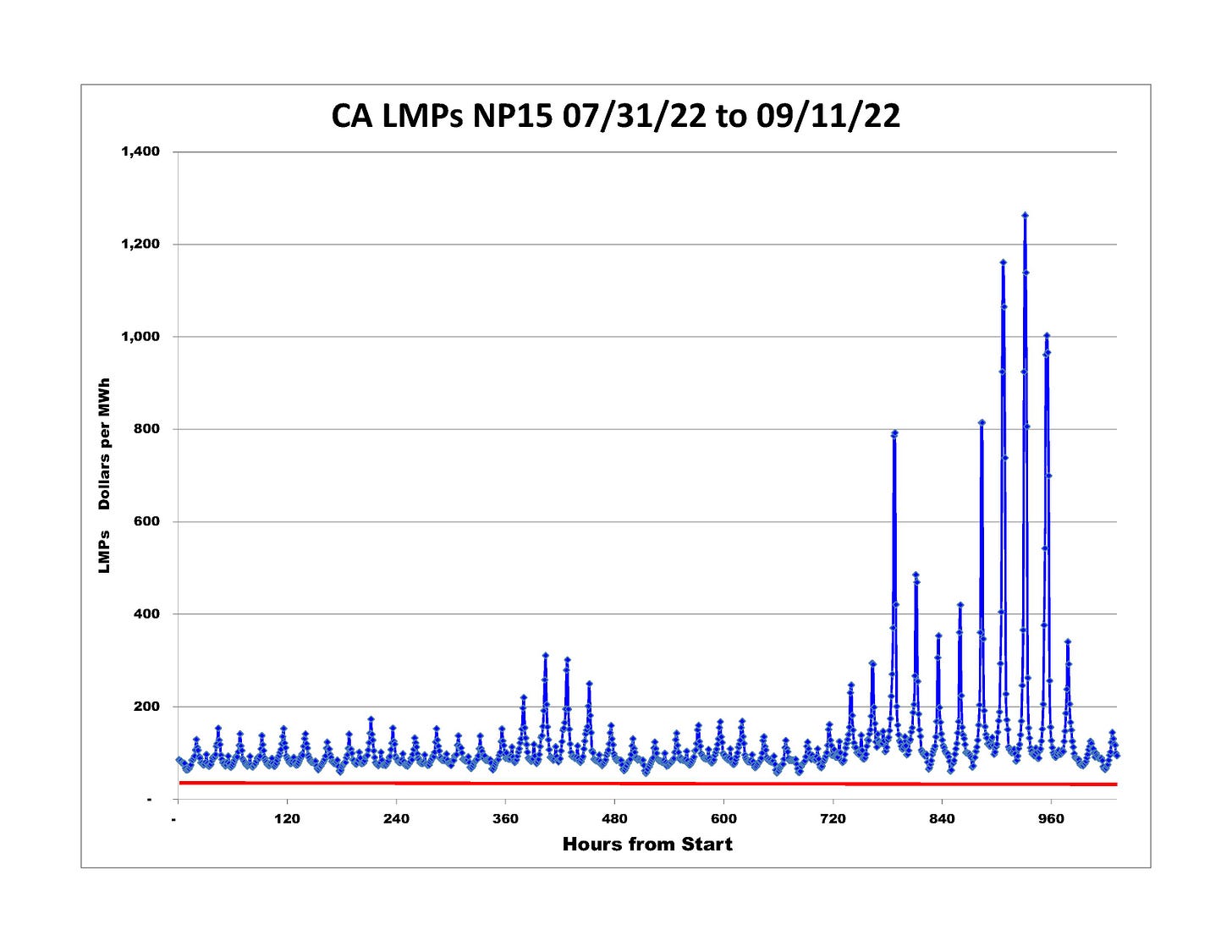

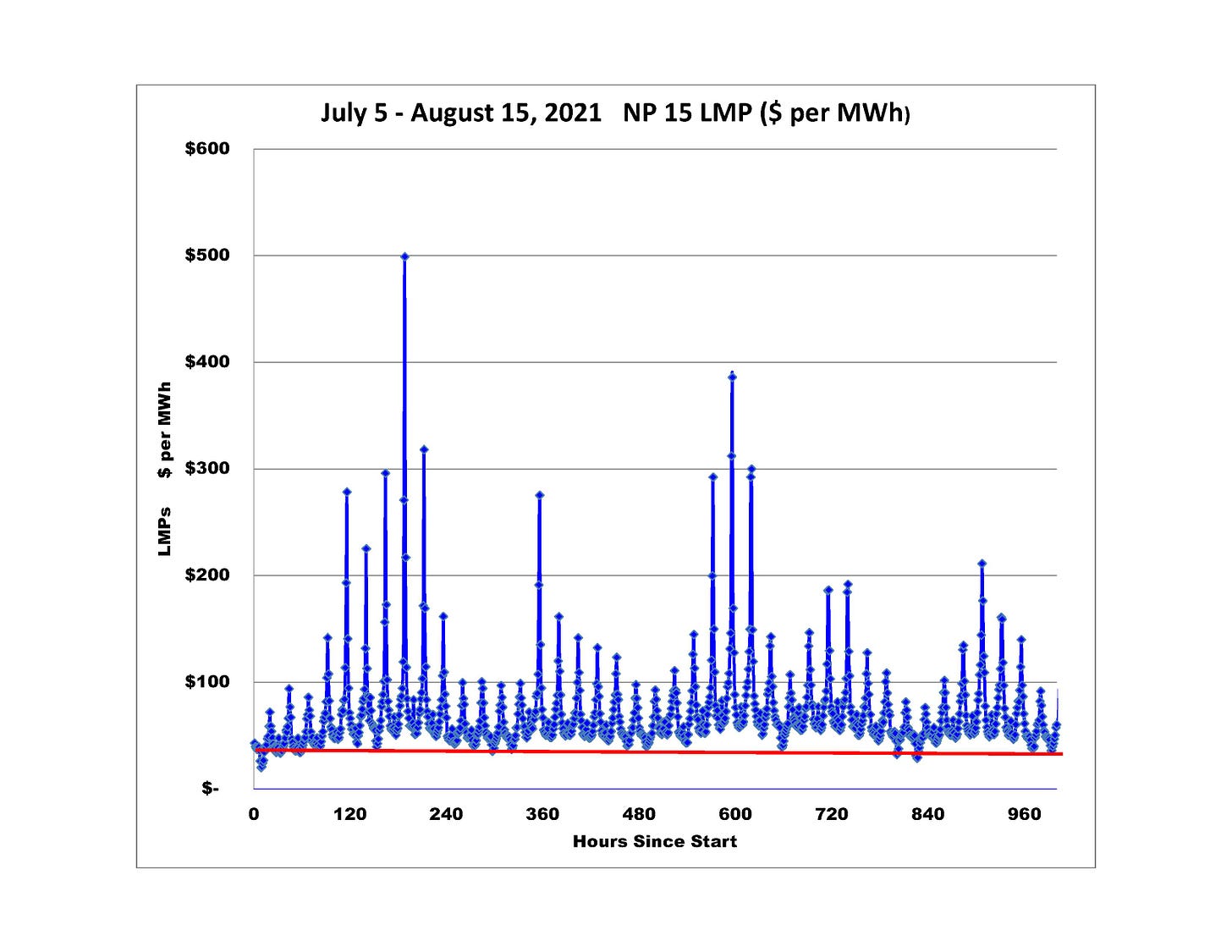

Since California wholesale electricity prices are set in a so-called "deregulated" market, they tend to skyrocket when outside factors diminish the supply of natural gas (which is the dominant energy supply for in-state generation,) strain the generation system during extended periods of California hot weather (such as occurred during August and early September, 2022,) or wildfires curtail the transmission lines that import the very large quantity of electric power into California.

Meredith Angwin discusses these problems found in ISOs and RTOs which harm ratepayers in her landmark 2020 book Shorting the Grid: The Hidden Fragility of Our Electric Grid. Re-regulation with vertically-integrated investor-owned-utilities (IOUs) would save California ratepayers money. When the California power grid is not stressed, wholesale rates are usually between about $40.00 / MWh and $60.00 / MWh.

The price graphs following the PG&E spreadsheet provide clear evidence that DCPP's nuclear power costs remain low and steady despite these challenges. This is likely why special interests and their nonprofit proxies continue to press for the plant's closure. The blue traces are the high California market revenues, at times above $1,200.00 per megawatt-hour (MWh) and the red horizontal lines show DCPP's modest operation costs. (1 MWh = 1,000 kilowatt-hours.) Note the range of DCPP's modest cost per MWh:

$35.22/MWh in 2021

$36.50/MWh in 2022

$41.48/MWh in 2023.

Overview of DCPP's net ratepayer benefits if SB 846 had applied to the years 2021, 2022, and 2023.

What is NP15? North of Path 15 - Most of PG&E’s service territory. What are LMPs? Locational Marginal Prices - the wholesale cost of electricity at a pricing node at a specific time and date.

Map showing NP15 from CAISO’s OASIS login page.

1. Natural Gas Transmission Impairments from a pair of natural gas transmission line explosions (in 2017 and 2021) drove up the cost of natural gas during high demand periods from late November, 2022 through early February, 2023, increasing California's wholesale electricity prices. The maximum was about $600.00 / MWh.

CA NP15 prices ($/MWh) 11/27/22 - 02/05/23

2. The California electric generation system was stressed during the August - early September 2022 Heat Storm. A record-high NP15 LMP greater than $1,200.00 / MWh occurred during a high demand period.

(Note the y-axis scale is larger than on the first graph.)

CA NP15 prices ($/MWh) 07/31/22 - 09/11/22

3. During the Bootleg Fire from July 6, 2021 – August 15, 2021, near the Oregon-California border, the 5,000 MW AC Intertie (Path 66) was threatened. This caused significant increases in NP15 LMPs, illustrating the wildfire vulnerability of long-distance electricity transmission moving power from other states to California.

CA NP15 prices ($/MWh) 07/05/21 - 08/15/21

The huge increases in California LMPs when the Bootleg Fire shut down two of the three parallel paths comprising Path 66 during the evening of July 9, 2021 was the subject of CGNP's June 15, 2022 panel presentation at the annual meeting of the American Nuclear Society. The PowerPoint and PDFs of the slides are available for download from CGNP's website.

General Comments

Diablo Canyon opponent's testimony utilizes assumptions leading to inflated DCPP cost projections. The most egregious example was the 2016 testimony in A.16-08-006 coordinated by PacifiCorp's nonprofit proxy, CEERT [1] and joined by organizations doctrinally opposed to nuclear power. This report [2], which the Commission and PG&E relied on projected 2025 DCPP power costs in the neighborhood of $100.00 per MWh, completely contrary to the U.S. nuclear power price trends. As noted earlier, the actual 2023 DCPP cost was a mere $41.48 per MWh. In 2022, the Breakthrough Institute prepared a concise rebuttal [3] of the faulty 2016 CEERT study. CGNP advises the Commission to take DCPP opponents's inflated DCPP cost claims with a proverbial grain of salt.

In a similar vein, CGNP reminds supporters of CAISO grid regionalization that Maryland decision-makers apparently believed the representations of PJM grid regionalization advocates that the right to set state electricity policies would be preserved. The Commission should take claims of state's rights preservation regarding electricity policy by CAISO grid regionalization advocates with a similar grain of salt. CGNP predicts that bedrock California environmental legislation such as AB 32, SB 100, and SB 1386 (Perata, 2006) will become quaint memories if CAISO grid regionaliztion is enacted. How will California's environmentally-conscious voters react?

Conclusion

CGNP's Opening and Reply Testimony document that DCPP is a cost-effective generator during extended operations. Thus, DCPP's costs are reasonable. DCPP's extended operations will likely result in rebates unless the controversial CAISO grid regionalization plan backed by PacifiCorp is enacted. If CAISO grid regionalization is enacted, SB 846 will likely be challenged in federal court by PacifiCorp. Following the reasoning in the 2016 case decided by the U.S. Supreme Court, Hughes v. Talen Energy [4] and a similar 2016 FERC Decision involving a nuclear power plant in Ohio, SB 846 would likely be invalidated under federal preemption, applying the U.S. Constitution's Commerce Clause likely yielding the probable PacifiCorp objective of shutting down the safe, reliable, abundant, local, cost-effective DCPP and largely replacing it with PacifiCorp's mostly coal-fired generation in and near Wyoming - with the associated air and water pollution and transmission risks, just as occurred when SONGS was needlessly closed at the end of January, 2012.

The SONGS power substitution has been obscured via the use of "unspecified power" in the power source labeling by IOUs such as SCE and SDG&E. (Unspecified power is mostly out-of-state coal-fired generation.) DCPP plays an important role in California electric power grid reliability by assuring large amounts of synchronous grid inertia [5] which would otherwise be supplied by PacifiCorp's out-of-state generation. Assuring California electric power grid reliability is one of the Commission's responsibilities. Keep Diablo Canyon running.

Additional supporting information is available at the CGNP website.

[1] Berkshire Hathaway Energy owns PacifiCorp. The most troubling conflict of interest during several relevant years was the Chairman of CEERT's Executive Committee, Attorney Jonathan M. Weisgall, continues to serve as Vice President of Legislative and Regulatory Affairs for Berkshire Hathaway Energy.

https://ceert.org/about-ceert/ceert-board/jonathan-m-weisgall/

[2] https://web.archive.org/web/20161123130308/http://webiva-downton.s3.amazonaws.com/877/6d/5/8551/PlanBfinal.pdf

[3] "The Faulty Diablo Canyon Study that Started it All - How Friends of the Earth and a Prominent Renewable Energy Lobbyist Hoodwinked California Policy-Makers," Jonah Messinger, Seaver Wang, and Adam Stein, August 30, 2022, The Breakthrough Institute, Oakland, California.

https://thebreakthrough.org/issues/energy/the-faulty-diablo-canyon-study-that-started-it-all

[4] Hughes v. Talen Energy Marketing Consolidated with CPV Maryland, LLC v. Talen Energy Marketing

https://www.scotusblog.com/case-files/cases/nazarian-v-ppl-energyplus-llc/

Docket No. Op. Below Argument Opinion Vote Author Term

14-614 4th Cir. Feb 24, 2016 Apr 19, 2016 8-0 Ginsburg OT 2015

Holding: Maryland's regulatory program to encourage development of new in-state energy generation is preempted by the Federal Power Act, which vests in the Federal Energy Regulatory Commission exclusive jurisdiction over interstate wholesale electricity rates. Judgment: Affirmed, 8-0, in an opinion by Justice Ginsburg on April 19, 2016. Justice Sotomayor filed a concurring opinion. Justice Thomas filed an opinion concurring in part and concurring in the judgment.

[5] https://greennuke.substack.com/p/why-is-grid-inertia-important

Here's a relevant post from almost two years ago (September 6, 2022) regarding the California Heat Storm discussed in the article - and the important role of Diablo Canyon in maintaining grid reliability.. https://www.manhattancontrarian.com/blog/2022-9-6-another-round-of-rolling-blackouts-in-california

I highly recommend the Manhattan Contrarian blog by retired Attorney Francis Menton.

Thank you for all your hard work and contributions in the field